Tax offsets v tax deductions and what you should be claiming on this financial year

|

|

Given that it is 30 June I thought I would quickly address the difference between a tax deduction and a tax offset, and point out what you should be claiming on this financial year. I find that a lot of people get the two of these mixed up, so I’ll clarify this for you today.

A tax deduction is an amount that you reduce from your overall taxable income. |

(Read it back slowly if you have to)

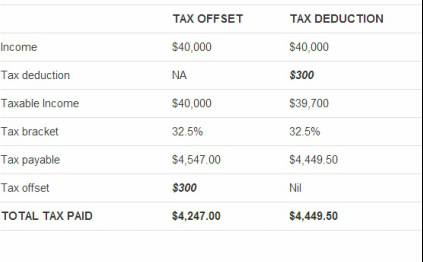

The table below should help with this

Clearly from the above, a deduction and an offset leave you in different positions. Sometimes people think that if they get a deduction they will receive the full amount back at tax time, and this is definitely not the case.

So then, now that we all know the difference between an offset and a deduction, I’ll point out some of the common, and not so well known offsets and deductions that may apply to you, to help get you ready for the end of financial year.

Deductions:

- HECS or HELP payments.

- Specific work clothes, sunglasses, uniforms, sun protectors. Anything that is specific and necessary to do your job.

- Dry cleaning of the above work clothes.

- You can claim up to $300 worth of miscellaneous expenses without receipts.

- The expenses to get your tax done the year before (accounting fees).

- Self-education expenses. Any self-education expenses that relate to your work including the uni fees, travel to and from the school, text books, even child care for children during the study time.

- Car expenses if you use your car for work. Keeping a log book is important for this.

- Home office expenses. If you work from home for some or part of your working time, you will be able to claim a percentage of your home office expenses. Think electricity, heating, and internet costs.

- Donations. Have you given to charity this year either as a one off donation or ongoing direct debit?

- Income protection insurance premiums.

- Any interest you pay on loans where the money is used to fund an investment. This could be shares, property, managed funds etc etc.

Sorry, but with all of the above you don’t actually get all of your money back, you only get that amount deducted from your taxable income. That’s not a bad deal though, it does mean you pay less tax, but don’t expect a lump sum in your bank account.

Offsets (AKA Rebates):

- If you received any dividends (from shares) this year, check for franking credits attached to them. These are offsets.

- The Net Medical Expenses Tax Offset for total medical expenses over and above $2,000 (this is only applicable if you claimed for medical expenses in the 2012/13 financial year).

- A percentage of your health insurance premiums if you haven’t already. Usually when you get health insurance they ask if you want the tax offset upfront, which gives you lower premiums. You will need this information at tax time, but if you haven’t already claimed the tax offset upfront, make sure you do it in your tax return.

- Low Income Earner Tax Offset. If you earn under $37,000 you could be eligible to receive this offset.

Good news, the above offsets are directly deducted from your tax payable. So, if you don’t have any tax payable, you will get this back in cash. Win!

These lists are not exhaustive and there are more out there, but the above are the most common personal deductions and unfortunately some of them are missed if you don’t know what you are looking for.

For most people, finance and tax planning are about as exciting as watching grass grow, but having a little bit of knowledge about what you can and can’t claim could mean money in your pocket.

– This post is from our resident senior financial planner, Cara Brett. Check out her details in our about us page.

Posted in: Financial Planning and Cara Brett