Do you think you can flip a house? Here are the costs involved

|

|

I love a good house renovating show, I really do. How I wish I had millions to renovate these fancy houses with up to the minute decorating throughout and the best fixtures you can get your hands on. I can daydream….

These shows have been around for a few years, and seem to be pretty popular. An interesting side effect however, is the number of people who are now getting into renovating for profit, or are looking at getting into it. |

One thing we do understand however, is the financial side, and let’s be honest, it is usually the reason you decide to ‘flip a house’.

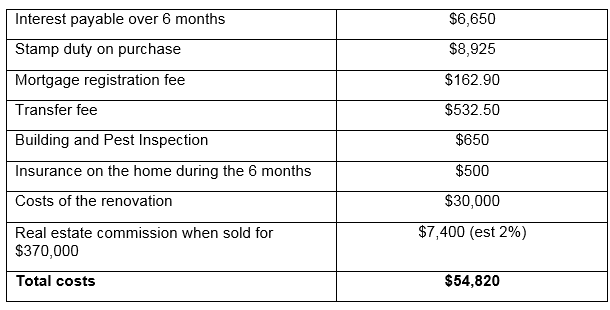

One thing that many people don’t understand is the extra costs involved in flipping a house. There are the actual renovating costs like carpentry and new tiles, but you need to understand the extras. Below I have outlined some of the costs you need to consider if you are going to get involved in this.

Stamp Duty: Stamp duty is mandatory, you can’t get out of that cost, and for investment properties it is higher.

Capital Gains Tax: Whatever profit you make on your reno when you eventually sell it, will be subject to Capital Gains Tax. If you hold the property for over 1 year, you will get a discount on that, but if you hold it under a year, you will be whacked with the full amount. Whatever profit you make, will be taxed at your marginal tax rate.

Interest repayments: If you have borrowed money in order to renovate your investment, you will have to pay the interest repayments on your loan. You better make sure you have enough in your cash flow to cover that while you are putting in the man hours on the weekends.

Selling costs: Unless you intend on selling the property yourself, you are going to have to pay a real estate agent to sell the property. This is usually dependent on the sales price and has been estimated to be between 2% to 3% of the sales price.

All of the above don’t even include potentially the most substantial cost, which is the cost of the renovation itself. As you probably know how much I love a good case study to put it into perspective, below outlines a typical house flip scenario.

Case study

Purchase price $300,000

Loan amount: $280,000 – interest only at 4.75%

You intend on spending $30,000 overhauling this property, and would like to sell it after 6 months for $370,000.

Let’s do the maths:

We now assume that you sell your property for $370,000. Your gross profit is $70,000, however you then take off your expenses of $54,820, your profit is now: $15,180.

Now comes the Capital Gains tax (CGT). As you sold the property within 12 months, the full amount is subject to CGT at your marginal tax rate. You are in the 32.5% tax bracket, so you will need to pay approximately $4,500 in tax.

So after 6 months’ worth of hard work, your total actual profit, will be somewhere around the $10,680.

Was all that work, and outlay of cost worth $10,680 to you. Well in this situation we are looking at a profit, which is great, but there are many situations out there that actually leave you with a loss.

There are actually more costs associated such as the loan establishment fees and ongoing fees, conveyancing fees, the opportunity cost of have $20,000 of your own money tied up for 6 months. The profit would realistically be less in the above scenario.

If you are going to get into this because you have a keen eye for details and enough get up and go to do the work yourself, then good on you, just make sure you do the figures to see if it is actually a viable investment. Remember you need to have a realistic understanding of what the property will actually sell for. Do your research on the area you are investing in and make sure your figures are achievable, and that the renovation is worthwhile for you.

The post is from our resident Financial Planner Cara Brett, check out her details in the About Us section.

Posted in: Cara Brett, Investments and Financial Planning