Dollar cost averaging

comes to entry or exit. There is the risk that you could buy when the markets are up or sell when the markets are down.

The general idea of dollar cost averaging is to invest a set amount on a regular basis, no matter whether the markets are up or down. This also ties in well with anyone who has surplus income on a regular basis and is ready to invest consistently.

Employing this regular contribution strategy as well as reinvesting the earnings will build on your investment portfolio and contribute to the ongoing compounding of your investments.

Many investment vehicles have the option of making a regular direct debit payment to build your investment. This could be managed investments, shares and ETFs for example. Usually for as little at $100 or $200 a month, you can grow your investment over the long term.

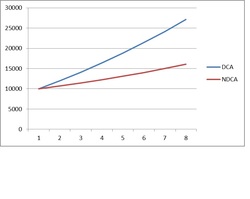

The best way for me to show you this however is with a super exciting graph that we are known for in the finance industry.

NDCA: No dollar cost averaging

This is $10,000 invested over 8 years. The red line is $10,000 sitting there earning 7% per year, with no ongoing contributions.

The blue line is $10,000 earning 7% per year, but investing a measly $100 a month.

$27,167 after 8 years when making regular contributions.

Those figures don’t impress you yet?

Red line: increases by 62%

Blue line: increases by 271%

We all know that the more we put away the better it is, but there is no perfect time to invest. Investing religiously at regular intervals will pay dividends (literally) in the long run. Even when the markets go down one month, they will go up another. There is no way for you to know. But I would bet that you would be happy with a 271% increase on your initial investment of $10,000 in the above situation.

$100 a month may seem like a lot to some people, but if you can invest a small amount regularly, I dare say you will be glad that you did. Do you spend $25 a week on coffee? There is your $100 right there.

– This post is from our resident senior financial planner, Cara Brett. Check out her details in our about us page.

Posted in: Financial Planning, Investments and Cara Brett